QUARTERLY FINANCIAL RESULTS

LEXICON BANK REPORTS FINANCIAL RESULTS FOR THE FIRST QUARTER OF 2023

First Quarter 2023 Highlights

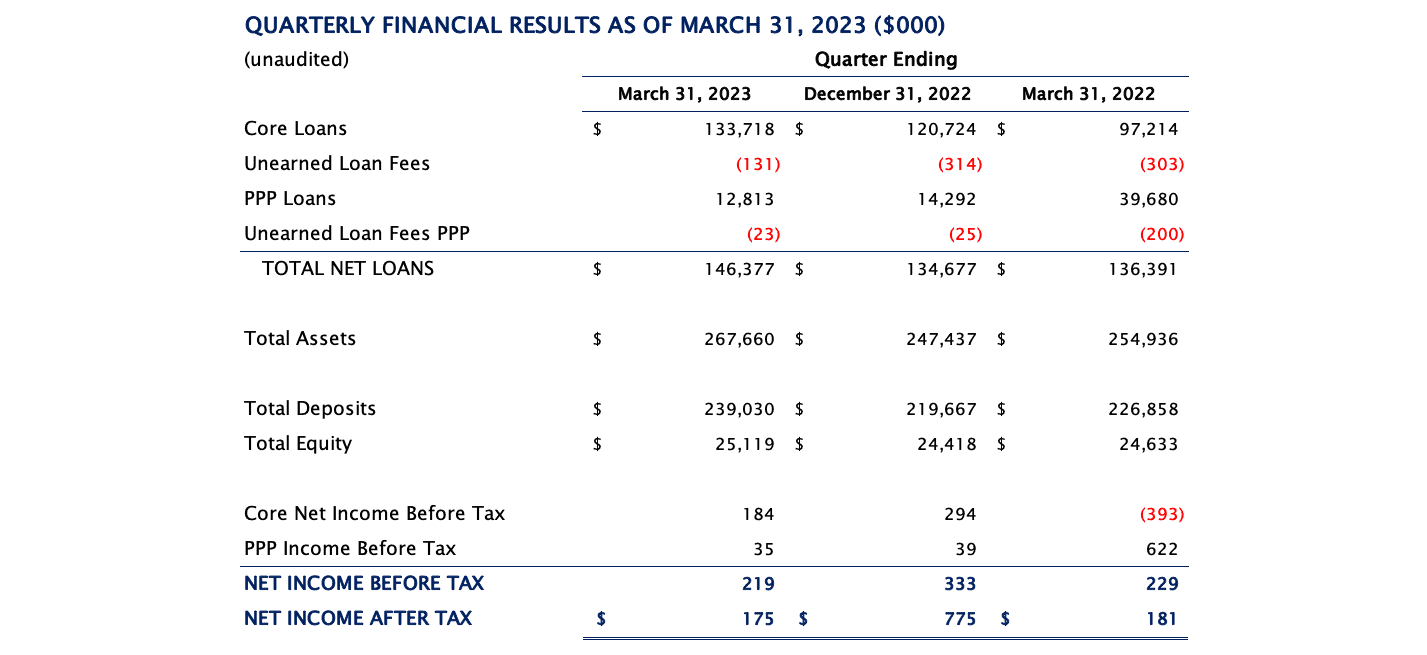

- Core loans, net of fees, increased by $13.2 million, up 10.9% from the prior quarter to a total core loans net of fees of $133.6 million.

- Approximately 200 new deposit accounts were opened in the quarter with $19.8 million in new deposits, bringing total deposits to $239 million.

- Net income after tax for the quarter was $175,000.

Lexicon Bank (“Bank”) announces unaudited results for the quarter ending March 31, 2023. The Bank continued to focus on personalized services for clients as its core balance sheet saw strong growth in both loans and deposits during the quarter.

As of March 31, 2023, the Bank’s assets totaled $267.7 million, an increase of $20.2 million from the prior quarter. Core loans and deposits increased by $13.2 million and $19.4 million, respectively, for the quarter. PPP loans, net of fees, decreased by $1.5 million for the quarter to $12.8 million.

Core loans, net of fees, grew to $133.6 million as of March 31, 2023, an increase of $13.2 million from the prior quarter. The Bank’s core loan portfolio had zero delinquencies and no charge-offs for the quarter. The weighted average interest rate on the core loan portfolio increased from 5.18% on December 31, 2022 to 5.51% on March 31, 2023.

Total deposits grew to $239.0 million in the first quarter, an increase of $19.4 million from the prior quarter. This growth is primarily due to an increase in all deposit categories with the largest growth coming from non-interest-bearing and CD accounts. Non-Interest bearing transaction account balances increased by $7.2 million in the quarter to $89.0 million. Retail CDs increased by $8.3 million to $25.6 million. The average cost of deposits for the quarter increased to 1.01% compared to 0.72% the prior quarter, primarily due to increases in deposit rates and interest-bearing transaction balances.

Total equity increased by $700,000 during the first quarter of 2023. This was primarily due to an improvement of $498,000 in unrealized loss on AFS securities net of tax, and net income after tax for the quarter of $175,000. First quarter 2023 net income was below fourth quarter 2022 due to the recognition of a net tax benefit of $489,000 in the prior year.

“Lexicon has solidified its position in Southern Nevada as the bank for business, no matter the size,” said Stacy Watkins, President and CEO of Lexicon Bank. “Our community continues to grow at a rapid pace, and we are proud to walk side by side with our clients and provide them with the lending and business services they need to achieve their financial goals. We do this while also offering unparalleled, concierge-like customer service. We continue to remain focused on the health of our existing loan portfolio and deposits, and our liquidity has allowed us to continue lending at a time when other banks have stopped lending altogether. We opened approximately 200 new accounts in the first quarter of the year, which is approximately a 90% increase from the same period last year. Of those new accounts, approximately 50% were opened in March after disruptions occurred in the banking industry. The Bank also grew our IntraFi deposit totals. IntraFi is a program the Bank is a member of that allows our customers the ability to place large dollar funds with the Bank and effectively ensures 100% FDIC coverage, helping provide our clients with peace of mind. We are excited for the growth opportunities and our team’s ability to best serve Las Vegas’ businesses.”

ABOUT LEXICON BANK

Founded in 2019, Lexicon Bank is Nevada's community-focused banking partner. Lexicon Bank provides personal, comprehensive banking services to business and individual banking clients, emphasizing creating and nurturing long-term relationships. By providing personalized services to all clients, Lexicon Bank helps to foster Southern Nevada's economy and community—ultimately helping to grow and develop the region's local businesses. The Bank is redefining banking as it should be in Southern Nevada by creating a concierge-like experience for businesses, regardless of size. Lexicon Bank is located in Tivoli Village at 330 S. Rampart Blvd., Suite 150. The Bank is open from 9 A.M. to 5 P.M. Monday through Friday and 10 A.M. to 2 P.M. on Saturdays. Clients can contact us by phone at (702) 780-7700 or online at lexiconbank.com. Follow us on Facebook, Instagram, LinkedIn, and Twitter @lexiconbank. Lexicon Bank is a member of the FDIC.