QUARTERLY FINANCIAL RESULTS

LEXICON BANK REPORTS FINANCIAL RESULTS FOR THE SECOND QUARTER OF 2023

Second Quarter 2023 Highlights

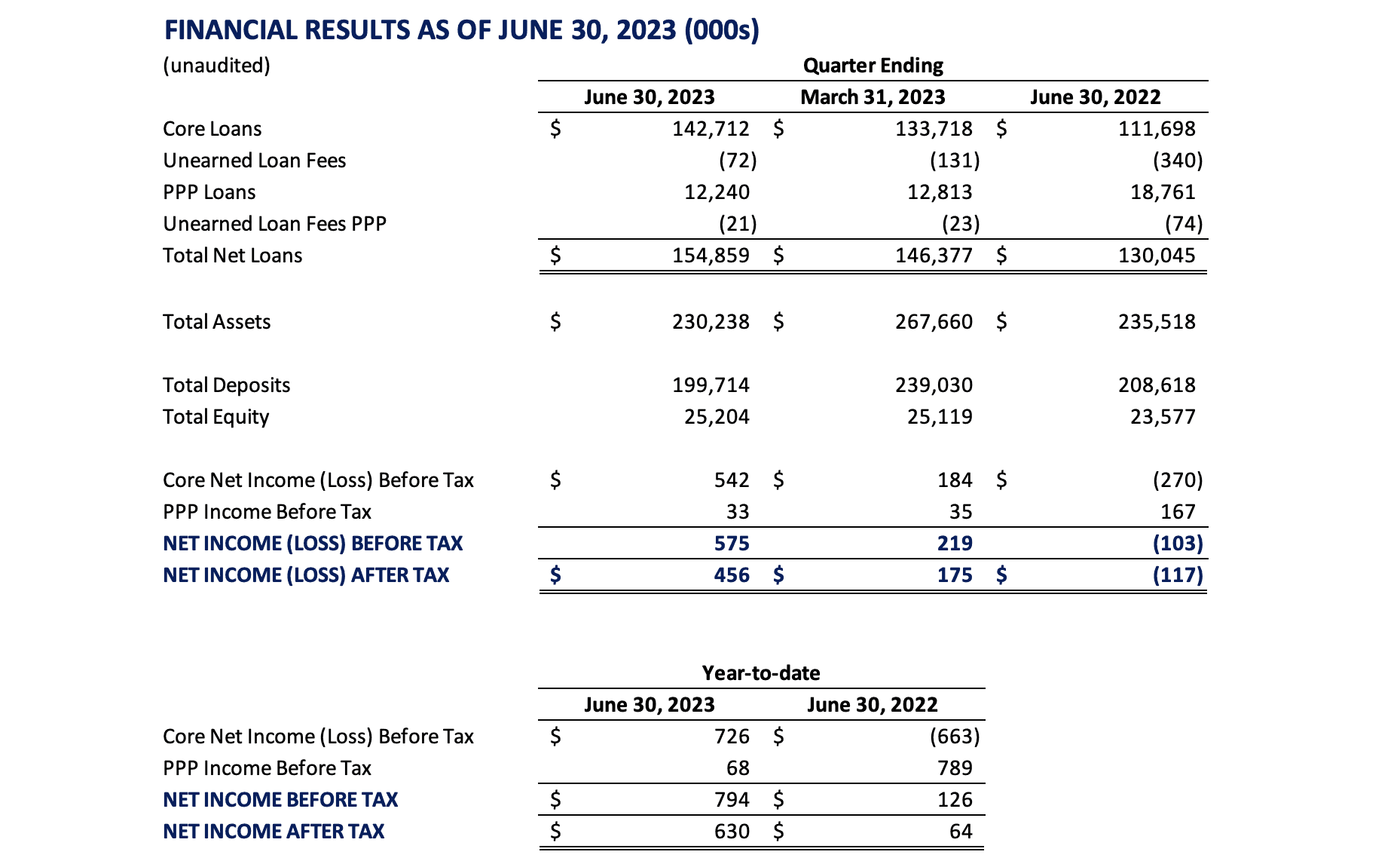

- Core loans, net of fees, increased by $9.1 million, up 6.7% from the prior quarter to a total of $142.6 million.

- Increased deposits by 170 new accounts and $23.1 million, resulting in total deposits of $199.7 million.

- Net income after tax for the quarter was $456 thousand, and $630 thousand year-to-date.

Lexicon Bank (“Bank”) announces unaudited results for the quarter ending June 30, 2023. The Bank continues to focus on personalized services for clients, our core balance sheet with strong growth in loans, and strategically managing our deposit base as further discussed below.

Core loans, net of fees, grew to $142.6 million as of June 30, 2023, reflecting year-to-date growth of $22.2 million. The Bank’s core loan portfolio had zero delinquencies and one small charge-off of less than 10 basis points of total loans for the quarter. The portfolio remains healthy and strong. PPP loans, net of fees, decreased by $0.5 million for the quarter to $12.2 million. The weighted average interest rate on the core loan portfolio increased from 5.18% on December 31, 2022 and 5.51% on March 31, 2023 to 5.74% on June 30, 2023.

Total deposits decreased by $39.3 million in the second quarter reflecting the anticipated reduction in one large depositor which had been held in cash at March 31, 2023 and, therefore, had no impact on the Bank's overall liquidity position. Most banks operate at a higher loan-to-deposit ratio in the 70% to 80% range to effectively utilize its liquidity and capital. The Bank has operated with a loan-to-deposit ratio in the 60% range. By appropriately sizing the deposit side of the balance sheet, the Bank now reports an approximately 70% loan-to-deposit ratio reflecting a better utilization of capital and liquidity. Additionally, the average cost of deposits for the quarter decreased slightly to 0.98% compared to 1.01% in the prior quarter, primarily due to decreases in higher rate deposit accounts and changes in the mix of deposit balances.

Total equity increased by $85 thousand during the second quarter of 2023. This was primarily due to an increase of $456 thousand from net income after taxes offset by a $388 thousand increase in the unrealized losses on securities, net of taxes.

The second quarter 2023 net income after tax was above the first quarter 2023 primarily due to the improvement in net interest income. The increase in net income after taxes year-to-date 2023 compared to 2022 was primarily driven by a $1.3 million dollar increase in net interest income offset by an increases in the provision for credit losses of $200 thousand and non-interest expenses of $441 thousand.

As of June 30, 2023, the Bank’s assets totaled $230.2 million, a decrease of $37.4 million from the prior quarter.

“Lexicon remains committed to Southern Nevada,” said Stacy Watkins, President and CEO of Lexicon Bank. “We are focused on continued growth and diversification of deposits with more than 170 new accounts opened in the quarter. While we experienced some right-sizing, we continue to see positive improvement in key indicators such as net interest margin while controlling expenses. Our deposit pipeline is robust, and we offer services such as IntraFi so that our clients can maintain a single banking relationship with Lexicon. Our liquidity and capital positions remain strong, and we continue to lend to our community as well as grow and diversify our deposit base.”

Lexicon Bank welcomed a new Branch Manager in the second quarter. Isabel Ruelas joined the Lexicon Bank team in April and is responsible for overseeing day-to-day branch operations, staff performance, client relations, and ongoing community involvement of the Bank. Isabel brings more than 14 years of experience in the financial industry, with previous employers ranging from Bank of America to Silver State Credit Union. Fluent in both English and Spanish, Isabel plays an integral role in the Bank’s continued commitment to Southern Nevada and we are very fortunate to have her on the team. Along with Isabel’s appointment, Michelle Jensen has been promoted to Operations Manager.

ABOUT LEXICON BANK

Founded in 2019, Lexicon Bank is Nevada's community-focused banking partner. Lexicon Bank provides personal, comprehensive banking services to business and individual banking clients, emphasizing creating and nurturing long-term relationships. By providing personalized services to all clients, Lexicon Bank helps to foster Southern Nevada's economy and community—ultimately helping to grow and develop the region's local businesses. The Bank is redefining banking as it should be in Southern Nevada by creating a concierge-like experience for businesses, regardless of size. Lexicon Bank is located in Tivoli Village at 330 S. Rampart Blvd., Suite 150. The Bank is open from 9 A.M. to 5 P.M. Monday through Friday and 10 A.M. to 2 P.M. on Saturdays. Clients can contact us by phone at (702) 780-7700 or online at lexiconbank.com. Follow us on Facebook, Instagram, LinkedIn, and Twitter @lexiconbank. Lexicon Bank is a member of the FDIC.

This press release includes “forward-looking statements,” as such term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on the current beliefs of the Bank’s Board and executive officers (collectively, “Management”), as well as assumptions made by and information currently available to the Bank’s Management. All statements regarding the Bank’s business strategy and plans and objectives of Management of the Bank for future operations are forward-looking statements. When used in this press release, the words “anticipate,” “believe,” “estimate,” “expect” and “intend” and words or phrases of similar meaning, as they relate to the Bank or the Bank’s Management, are intended to identify forward-looking statements. Although the Bank believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors that could cause actual results to differ materially from the Bank’s expectations (“cautionary statements”) are the effects of the COVID-19 pandemic and related government actions on the Bank and its customers, loan losses, changes in interest rates, loss of key personnel, lower lending limits and capital than competitors, regulatory restrictions and oversight of the Bank, the secure and effective implementation of technology, risks related to the local and national economy, the Bank's implementation of its business plans and management of growth, loan performance, interest rates, and regulatory matters, the effects of trade, monetary and fiscal policies, inflation, the effects of natural disasters, and changes in accounting policies and practices. Based upon changing conditions, if any one or more of these risks or uncertainties materialize, or if any underlying assumptions prove incorrect, actual results may vary materially from those described as anticipated, believed, estimated, expected, or intended. The Bank does not intend to update these forward-looking statements.